Worldwide Indirect tax

April 25, 2024

EY releases the 2024 edition to its famous Free Indirect Tax Guide!

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

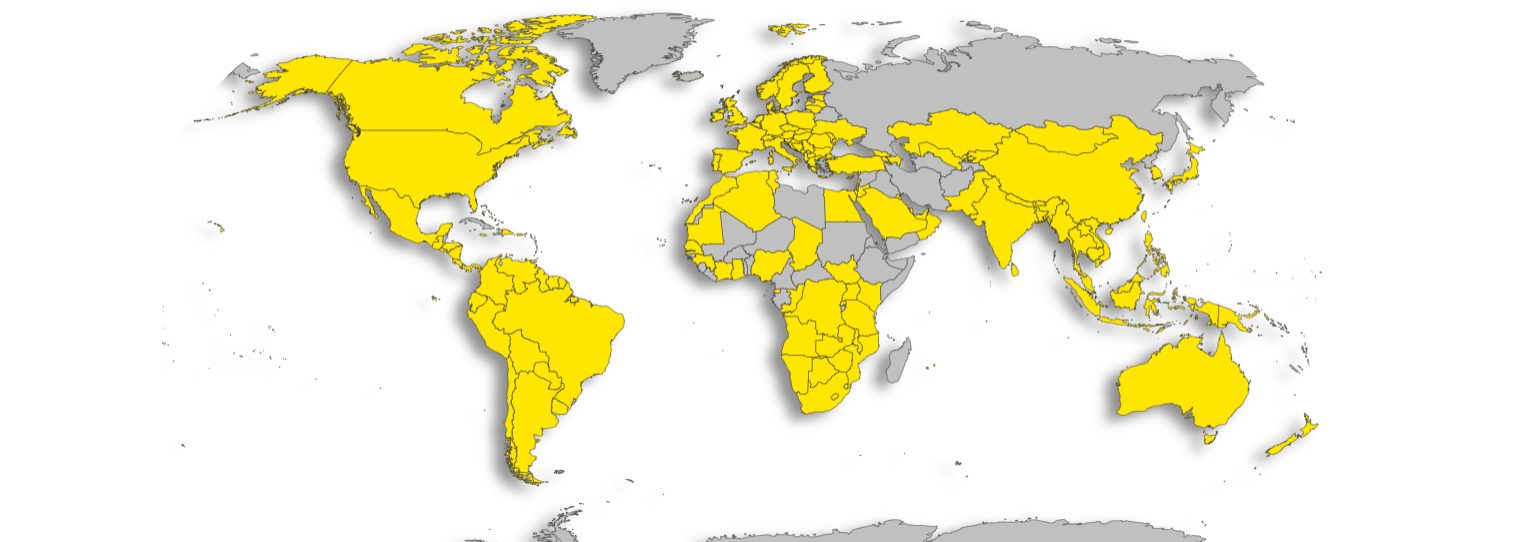

EY has recently released the highly anticipated 2024 edition of its annual reference book, offering an overview of value-added tax (VAT), goods and services tax (GST), and sales tax systems across 150 jurisdictions worldwide. This comprehensive guide, featuring the latest insights as of 1 January 2024, is now available for free download in PDF format.

Expansion and Updates: The 2024 edition introduces new chapters covering emerging markets such as Kyrgyzstan, Mauritania, Saint Kitts and Nevis, and Saint Vincent and the Grenadines. These additions enhance the guide's breadth and provide valuable information on tax systems in these jurisdictions.

Key Topics Covered: The guide addresses a wide range of topics related to consumption taxes, including:

- Scope of the tax

- Taxpayer liability

- Tax rates

- Time of supply

- Input tax recovery for both taxable persons and non-established businesses

- Invoicing procedures

- Return filing and payment methods

- Penalties for non-compliance

Focus on Electronic Invoicing: Acknowledging the significant legislative changes in electronic invoicing globally, the 2024 edition features expanded content on this topic. The guide offers insights into the impact of electronic invoicing on businesses and how they can navigate these changes effectively.

Other Resources: At the end of the guide, readers will find useful lists containing the names and codes of national currencies, as well as VAT, GST, and sales tax rates for each jurisdiction covered.

Why we endorse it: This comprehensive resource serves as a valuable tool for tax professionals and businesses operating in diverse global markets and we applaud EY to continue updating this guidebook and making it available free of charge, enabling access to indirect tax knowledge from around the world.

Download it:

This great resource is available for download here: Worldwide VAT, GST and Sales Tax Guide | EY - Global

About Authors:

LATAM | Tax Policy

How Regional Cooperation and Exchange of Information (EOI) are Driving Revenue Growth and Fairer Tax Systems.

US | Big 4

Job Cuts Hit Recently Hired and Promotion-Eligible Staff as PwC Adjusts to New Realities

UK | Transfer Pricing

Stakeholders are invited to review the draft legislation and submit their feedback by 11:59pm on 7 July 2025. The consultation follows a 2023 policy review and includes detailed supporting documents, such as explanatory notes and revised statements of practice

Egypt | Tax Policy

Through Its E-Commerce Tax Unit, the Egyptian Tax Authority Engages with Egypt’s Digital Economy and Unveils Legislative Reforms to Support Startups, Freelancers, and Non-Resident Platforms

US | Customs

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

Egypt | VAT

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

Italy | VAT

Italy Seeks Nearly €1 Billion in VAT payments from Meta, X, and LinkedIn, Targeting Transactions from 2015 to 2022

Egypt | Tax Policy

Fostering Trust, Partnership, and Business Confidence Through Fair and Efficient Tax Services

Reach your target audience

Contact us at hello@taxspoc.com